BLOG

Finds and Interests

Interviewed & Written by: Brenda Kelley Kim

With the devastation across the country from Hurricane Helene, even those who do not live in coastal areas are seeing devastating damage from high winds and torrential rain.

Will Seippel, CEO of WorthPoint, the largest resource for identifying, researching, and valuing antiques, art, and vintage collectibles, is no stranger to storm surges and property damage. In September of 2022, Hurricane Ian slammed into the Florida coast, causing millions of dollars in damages.

Seippel had hundreds of collectibles, antiques, and artwork, many of which were destroyed by the storm. Even as an expert in the vintage and antique industry, he found the insurance claims process fraught with difficulty. It took months for his claims to be processed, and he discovered he was unprepared for such a disaster. Here are some pointers from someone who has been there and back on managing the insurance issues for antiques and vintage items.

WorthPoint: Are riders for specific items necessary, or is there a way to guarantee everything in your home is covered?

Will Seippel: Well, that depends on what is in your home. The first thing any homeowner should always do is have a documented and complete inventory of everything in your home. It can take a long time, and it might involve researching recent selling prices for your items, working with your insurance carrier, and then matching your policy coverage to your possessions. I have a piece of furniture that was made by a well-known artist friend. Is it art or a piece of furniture? What are the limits of each individual value? How does your insurance company/policy classify an item?

WorthPoint: How would a homeowner discover coverage limitations for vintage or high-end items?

Will S: You have to first understand the classification of your item vs. your policy and then understand your limitations and requirements. For example, the policy limit for jewelry might be $5,000 without a rider, but any item over $500 needs a rider. You also need to understand the policy exclusions for events. For example, the policy may cover theft or a fire but not cover anything in the case of a flood. Finally, you need to understand your coverage on different locations, for example, storage units, vacations, or a second home.

WorthPoint: What kind of documentation do you suggest for your items?

Will S.: I would verify the language in my policy to see where an authentication, appraisal, or such is needed, and if so, make sure to have those. At a minimum, for high-value items, whether you have a rider/appraisal or not, you will want high-quality digital images and a receipt if you have one. A digital image of the receipt should suffice.

WorthPoint: Are there any federal or other public programs to help homeowners navigate the claims process?

Will S.: The FEMA/SBA loans will loan you money for the broad loss of possessions in your home in a disaster area. While this likely will not allow you cash for a diamond engagement ring, it will cover general possessions in your home and give you the funds to replace things from toothpaste to a sofa. Generally, they require repayment at subsidized interest rates. In my personal experience, it is a good program; there is VERY intensive paperwork, including a lien on my home. It was a lifesaver as it took years to get my insurance reimbursement.

WorthPoint: If you could offer one piece of advice to homeowners, what would it be?

Will S.: Know the value, history, and relevance of what you have in your house and document it.

It’s impossible to tell if the devastation of a hurricane or flood will ever hit your home. WorthPoint has developed some tools that will help you be prepared for the worst. The WorthPoint Price Guide is an excellent first option for understanding the value of your items and beginning an inventory of your treasures. Check it out here.

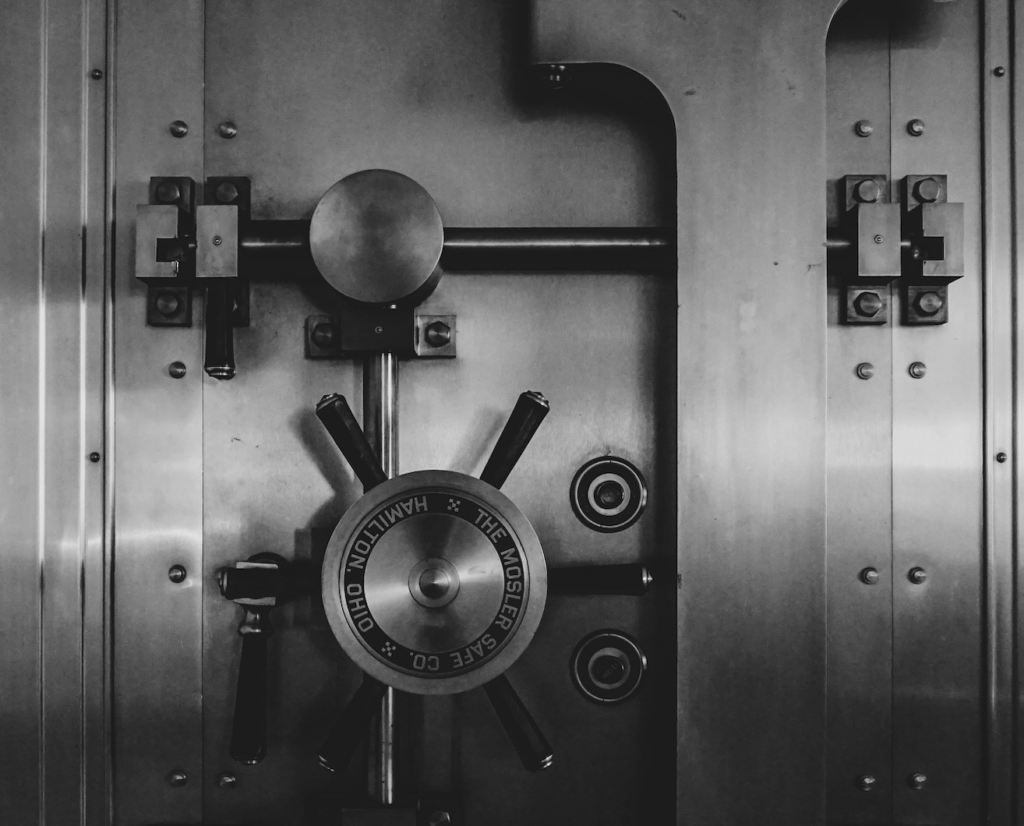

The WorthPoint Vault is a virtual solution designed to help you organize, track, and manage your prized possessions with ease. Offering secure online storage for detailed records, photos, and valuations of antiques and collectibles, the Vault ensures your collection is fully documented and accessible from anywhere. Whether for insurance purposes, estate planning, or simply keeping track of your cherished items, the Vault empowers you to stay organized while preserving the history and value of your treasures. Check it out here.